A key part of understanding a triple-net (NNN) lease is understanding tenant credit ratings. Before we discuss ratings, it’s important to first understand the basics of a triple-net lease.

Triple-net (NNN) leases are used in different property types including office, industrial, and retail buildings.

This type of lease is attractive to for many reasons. Most common, the attraction of NNN leases are due to its “hands-off” nature. They’re low management for you (the owner) and provide a steady source of income.

Briefly put, in a triple-net lease the tenant assumes responsibility for the property’s ongoing operating costs, in exchange for a long term lease.

If you are new to NNN leases, read this article before proceeding.

Calculating Risk with Tenant Credit Ratings

While triple-net leases provide many advantages, there are always risks involved with any investment. Calculating the risk of a NNN lease relies partly on the tenant’s quality. A key component of understanding a tenant’s quality is their credit rating.

What is a Credit Rating?

A tenant’s credit rating refers to their financial strength, and the likelihood of them fulfilling their responsibilities and payments, through their lease term.

It’s much like your personal credit score. The strength of your credit score determines how much you can borrow, and the terms and rates.

How Are They Determined?

Large national companies that issue public bonds, or other public debt, receive a credit rating. Credit ratings are determined by one of three major credit agencies: Fitch, Moody’s Investor Service (Moody’s), or Standard and Poor’s (S&P).

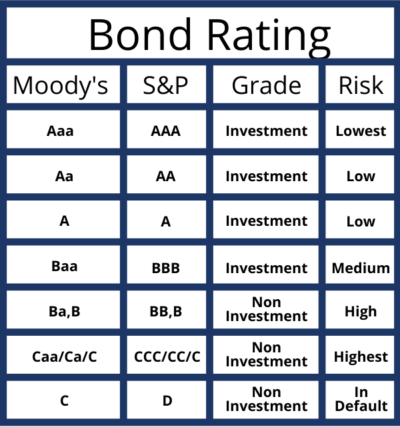

There are two main categories of ratings: investment grade and non-investment grade.

What Are The Different Ratings?

These grades are dependent on a specific rating by Moody’s, S&P, or Fitch. View the different bond ratings and their symbols, that range from low risk to high risk:

As you (the owner) review the credit of tenants, you’ll want to make sure they carry ratings with the lowest risk.

How do You Know Which Tenant Credit is Best?

The best credit ratings are triple A (AAA), and double A (AA), and single A (A) from either Moody’s or S&P.

A (Baa) rating from Moody’s, and a triple B (BBB) rating from S&P are both mediocre.

It’s important to note that while investment grade credit ratings are the best, non-investment grade bond ratings aren’t necessarily a red flag.

What Does It Mean to Have a Non-Investment Grade Rating?

Having a non-investment grade credit rating is known as having “speculative” credit. Often times, companies with this credit rating are viable businesses, but aspects of their operations reflect greater risk.

The company can be profitable today, but may carry large amounts of debt or be in an unstable industry.

Popular Companies Without a Credit Rating

An example of a corporation with a non-investment grade credit rating is Facebook. Similar companies may not have a credit rating because there is no debt to rate.

Additionally, private companies that don’t issue publicly traded debts or bonds don’t receive credit ratings. Two popular examples are Chick-fil-A and Ashley’s Furniture.

It’s important to highlight, unrated companies don’t always equal higher risk. It simply means determining their financial strength is more difficult, due to a lack of readily available financial information.

What Does It Mean to Have an Investment Grade Credit Rating?

For a credit to be considered investment grade, it must have an S&P rating of “BBB-”, or a Moody’s rating of “Baa”. Looking at the chart above, any rating below those are viewed as non-investment grade, or “speculative”.

Corporations with investment grade credit ratings have a low change of defaulting on loans, or not being able to pay its debt.

Keep in mind, credit ratings can change over time as S&P and Moody’s are always monitoring the financial health of corporations.

Be sure to know the latest credit ratings for popular tenants.

Popular Companies With Credit Ratings

Companies with investment grade credit include Walmart, CVS, McDonald’s, Advance Auto Parts and more. These companies are known as “credit tenants”.

When these corporations lease a property, its known as a “credit lease”.

What Does a Credit Tenant Mean For an Investment Property?

Having a credit tenant at your investment property provides a peace of mind for you (the owner). The tenant has a greater chance of remaining in business, making rent payments, and fulfilling other financial obligations.

If you ever do decide to sell, having a credit tenant at your property increases the sale value over a similar building without credit tenants. Even more beneficial is having the credit tenant occupy the property on long term leases.

Sign Up For Our Newsletter

For more informational articles, sign up for our newsletter here.