As the new year begins, it is imperative to view and investigate the economy and commercial real estate trends of the fourth quarter of 2017. Topics discussed in this overview will be the Federal reserve rates, the unemployment rate, payroll employment, and the commercial real estate market, specifically the retail, office, and industrial sectors.

The Federal Reserve Raised Rates

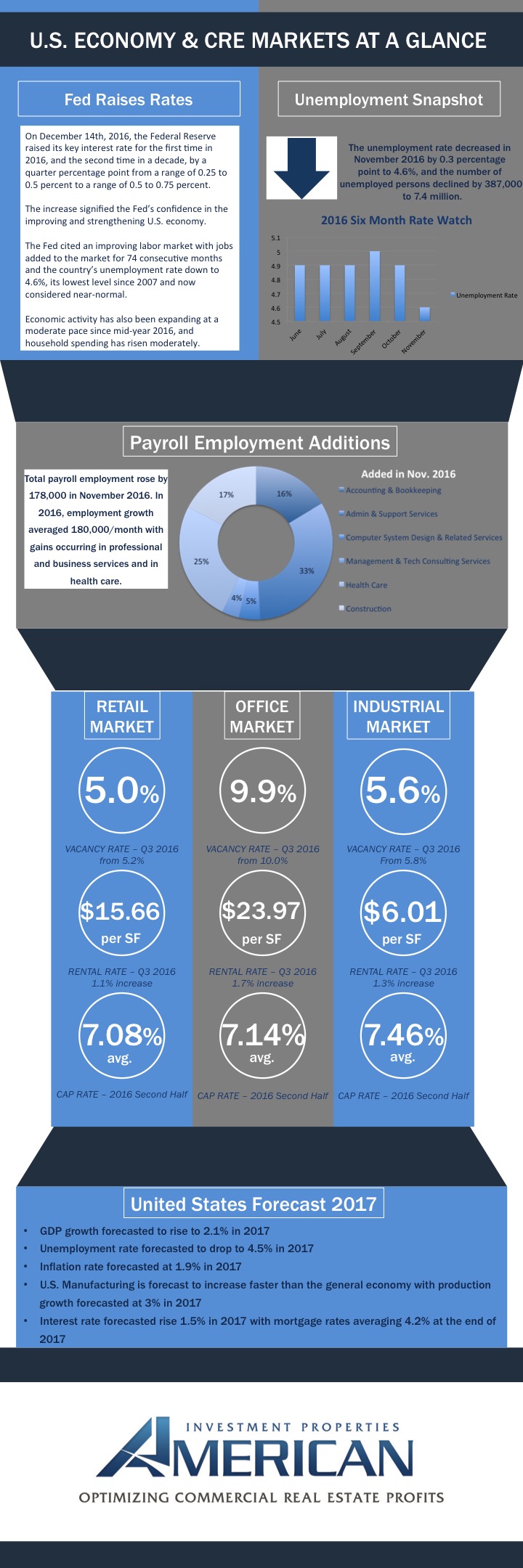

On December 14th, 2016, the Federal Reserve raised its key interest rate for the first time in 2016, and the second time in a decade, by a quarter percentage point from a range of 0.25 to 0.5 percent to a range of 0.5 to 0.75 percent. The increase signified the Fed’s confidence in the improving and strengthening U.S. economy. The Fed cited an improving labor market with jobs added to the market for 74 consecutive months and the country’s unemployment rate down to 4.6%, its lowest level since 2007 and now considered near-normal. Economic activity has also been expanding at a moderate pace since mid-year 2016, and household spending has rise moderately.

Overview of Unemployment and Payroll Employment Additions

The unemployment rate decreased in November 2016 by 0.3 percent to 4.6 percent, and the number of unemployed persons declined by 387,000 to 7.4 million.

Total payroll employment rose by 178,000 in November 2016. In 2016, employment growth average 180,000 per month with gains occurring professional and business services and in health care.

Payroll Employment Additions

- Construction – 17 percent

- Health Care – 25 percent

- Management & Tech Consulting Services – 4 percent

- Computer System Design & Related Services – 5 percent

- Administrative & Support Services – 33 percent

- Accounting & Bookkeeping – 16 percent

Commercial Real Estate Market End of Year

The commercial real estate market witnessed many changes during the 2016 end of year. First the retail market. This sector saw vacancy rates at 5.0 percent, a .2 percent decrease from third quarter results, and a rental rate of $15.66 per square feet, an 1.1 percent increase from the previous quarter. The average capitalization rate was 7.08 percent. Now, an overview of the office market performance. The vacancy rates for office buildings saw a slight decrease from 10 percent to 9.9 percent. The capitalization was reported at 7.14 percent, and the rental rate increased 1.7 percent, equaling to $23.97 per square feet. Third is the industrial market. The industrial market saw a slight decrease in vacancy rates from 5.8 percent to 5.6 percent, however rental rates are up by 1.3 percent at $6.01 per square feet. Last the average cap rate was reported at 7.46 percent.

United States Forecast for 2017

- GDP growth forecasted to rise to 2.1 percent in 2017

- Unemployment rate forecasted to drop to 4.5 percent

- Inflation rate forecasted at 1.9 percent

- United States Manufacturing is expected to increase faster than the general economy with production growth forecasted at 3 percent in 2017.

- Interest rate is projected to rise 1.5 percent in 2017 with mortgage rates averaging 4.2 percent at the end of 2017.