The first two quarters of 2017 showed diverse changes in the U.S. economy and commercial real estate markets. Here is a breakdown of the United States economy and commercial real estate market for the second quarter of 2017.

U.S. Economic Growth Prediction

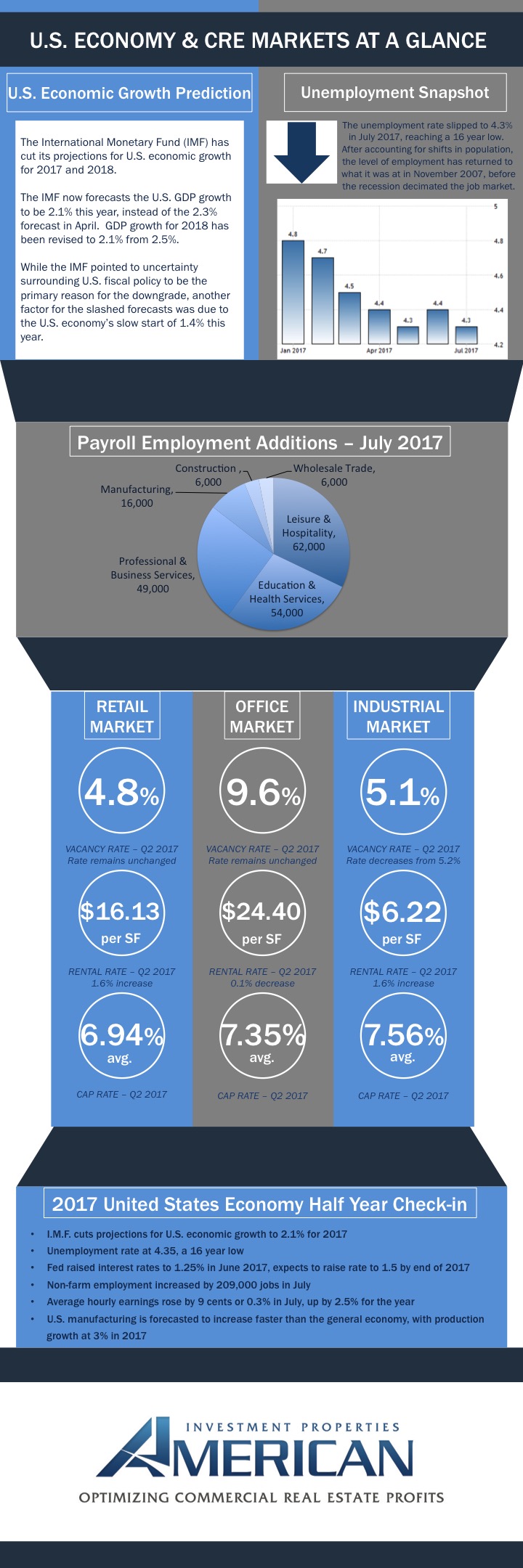

The International Monetary Fund (IMF) has cut its projections for U.S. economic growth for 2017 and 2018. The International Monetary Fund now forecasts the U.S. GDP growth to be 2.1 percent this year, instead of the 2.3 percent forecast in April. GDP growth for 2018 has been revised to 2.1 percent from 2.5 percent.

While the International Monetary Fund pointed to uncertainty surrounding United States fiscal policy to be the primary reason for the downgrade, another factor for the slashed forecasts was due to the U.S. economy’s slow start of 1.4 percent this year.

Brief Summary of U.S. Unemployment

The unemployment rate slipped to 4.3 percent in July 20117, reaching a 16 year low. Previously, June 2017 reported unemployment at 4.4 percent. The 2017 year began with a higher unemployment rate of 4.8 percent.

After accounting for shifts in population, the level of employment has returned to what it was at in November 2007, before the recession decimated the job market.

Payroll Employment Additions For July 2017

-

- Construction – 6,000

- Wholesale Trade – 6,000

- Manufacturing – 16,000

- Professional & Business Services – 49,000

- Education & Health Services – 54,000

- Leisure & Hospitality – 62,000

Commercial Real Estate Market Performance

The commercial real estate market shows various performances across the different sectors; retail, office, and industrial. In the retail market, vacancy rate remains unchanged at 4.8 percent.

Rental rates showed a 1.6 percent increase at $16.13 per square feet, and cap rates average at 6.94 percent. The office market sector showed a slightly better performance than retail. Office vacancy rates remained unchanged from previous months at 9.6 percent. The rental rate had a 0.1 percent decrease at $24.40 per square feet.

The average cap rate was reported at 7.35 percent. Lastly, the industrial market showed massive changes. The vacancy rate was reported in at 5.1 percent, a decrease from the previous 5.2 percent. Industrial rental rates showcased a 1.6 percent increase at $6.22 per square feet. Finally, the average cap rate was at 7.56 percent.